Happy February Sunshine!

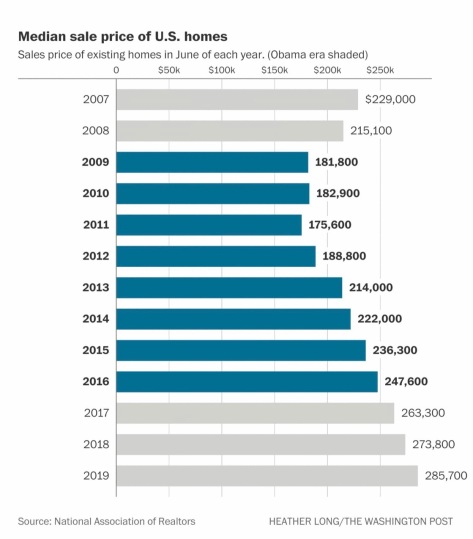

Today, and lately actually, we have been working with a lot of sellers and buyers that don’t know about certain fees/costs that are involved in the home buying process. Particularly, closing fees, title fees, inspections both government and home, etc. We found a FANTASTIC article written by houselogic.com discussing a lot of these “unknowns” that many people, especially first time home buyers, may not know about.

Check it out here: Unknown fees for a Buyer

To recap a lot of it here, a buyer has many fees when it comes to buying a home ON TOP of the actual purchase price. These costs can include an appraisal ordered by the lender, lender fees, title company and search fees that help provide clear title, possible survey fee if you want to know where your property ends and begins, home inspection fees including radon, sewer, pest & overall home, etc. ALL THINGS TO THINK ABOUT before you take the plunge into the home buying process :). We hope this helps brighten your day just a bit and gives you just a little more insight into the home purchase process and what to plan ahead for!

Have a Sunshine Day everyone! And remember, if you need help in selling, buying or both, we are here for you! Give us a call today at 636-336-1330 and ask for Ashley to get your simplified process started :). Everyone needs a little help every once in a while 😉

-The Sunshine Team

Ashley, Evelyn & Dana